Dates: 23 to 25 April 2025

Duration: 3 days

Level: Beginner

Venue: Singapore University of Social Sciences

This course presents participants with knowledge and skills required in successfully raising funds from angel investors. Participants will gain a comprehensive understanding of the process of raising funds from angel investors, and skills and knowledge needed to successfully navigate the process. The course is conducted through a series of exercises and case studies, as well as receive feedback and guidance from seasoned angel investors and entrepreneurs.

The course is a collaborative effort with ACE.SG (Action Community for Entrepreneurship)

Startup SG Founder Grant

Participants who complete this workshop together with Creating Sustainable Impact: Building Purposeful Ventures (CET189) or Startup Accelerator: Building and Growing Your Business (CET188) will fulfil the Entrepreneurship Training eligibility criterion as main applicants for the Startup SG Founder Grant (SSGF Grant)

Find out more at https://www.suss.edu.sg/experience-at-suss/entrepreneurship/startup-sg-founder-suss or contact [email protected] for enquiries on the SSGF Grant.

The course is suitable for anyone who is interested to know more about the process and techniques of fundraising from angel investors, and the necessary skills to successfully secure fundings from them.

- Introduction to angel investors

- Understanding the goals of angel investors, and align with your business

- Introduction of key terminologies and concept related to investing: valuation, due diligence and terms sheets

- Prepare a compelling pitch, identify clear value proposition and target market plan

- Understanding financial projections and valuation

- How to identify and approach potential angel investors

- Understanding the process of raising funding from angel investors

- Developing strategies for effective communication with investors

- Understanding common legal and financial considerations for angel investing

- Understanding the roles of angel investors

- How to manage expectations of angel investors

- Introduction on raising future rounds of funding

- Hands on training

- Pitch presentation

Master the knowledge and skills to confidently approach and secure funding from angel investors for your business.

A. Knowledge and Understanding (Theory Component)

By the end of this course, you should be able to:

- Understand the terminology and concepts related to angel investing, such as valuation, due diligence, and terms sheets.

- Understand key steps involved in raising funding angel investors and the common legal and financial considerations related to that.

- Understand the key elements of a compelling pitch, including concepts of value proposition, how to identify target market and business plan.

B. Key Skills (Practical Component)

By the end of this course, you should be able to:

- Identify and approach potential angels, and skills to effectively communicate with investors, including to address potential concerns and objectives.

- Create financial projects and understand how these can be used to establish a valuation for the company.

- Manage the expectations for angel investors and maintain a good working relationship.

| Time | Agenda |

|---|

| Day 1 |

| 09.00 - 11.00 | Introduction to angel investors &

Understanding the roles of angel investors |

| 11.00 - 11.15 | Break |

| 11.15 – 12.15 | Introduction of key terminologies and concept related to investing: valuation, due diligence and terms sheets

|

| 12.15 - 13.15 | Lunch Break |

| 13.15 - 15.15 | Prepare a compelling pitch, identify clear value proposition and target market plan |

| 15:15 - 15:30 | Break

|

| 15:30 - 17:30 | Understanding financial projections and valuation

|

| Day 2 |

| 09.00 - 11.00 | Understanding the goals of angel investors, and align with your business

|

| 11.00 - 11.15 | Break |

| 11.15 – 12.15 | How to identify and approach potential angel investors |

| 12.15 - 13.15 | Lunch Break |

| 13.15 - 14.15 | Understanding the process of raising funding from angel investors |

| 14.15 - 15.15 | Developing strategies for effective communication with investors |

| 15.15 - 15.30 | Break |

| 15.30 - 16.30 | Developing strategies for effective communication with investors |

| 16.30 - 17.30 | Understanding common legal and financial considerations for angel investing |

| Day 3 |

| 09.00 - 11.00 | How to manage expectations of angel investors |

| 11.00 - 11.15 | Break |

| 11.15 – 12.15 | Introduction on raising future rounds of funding (part 1) |

| 12.15 - 13.15 | Lunch

|

| 13.15 - 14.15 | Introduction on raising future rounds of funding (part 2)

|

| 14.15 - 16.15 | Pitch Preparation |

| 16.15 - 16.30 | Break

|

| 16.30 - 17.30 | Pitch presentation |

*SUSS reserves the right to change the course dates, topics and trainers.

Ang Ann Liang

Associate Director

Wong Tan & Molly Lim LLC

Ann Liang is currently an Associate Director at Wong Tan & Molly Lim LLC. He is a seasoned practitioner in commercial disputes, specialising in both litigation and arbitration across various areas, including employment, shareholder disputes, product liability, technology, cybersecurity, and insolvency. Ann Liang’s extensive experience encompasses issues such as non-competes, enforcement of arbitral awards, construction disputes, and defamation.

Jed Ng

Founder

Angel School

Jed is the founder of Angel School and a self-taught Venture Investor who has backed 2x Unicorns. He leads his own venture syndicate and is backed by 1400+ LPs. His latest venture is AngelSchool.vc, an Accelerator helping Venture Investors from their 1st check to leading Syndicates as 'Super Angels'. Through his programs, he has trained 300 angels in 40 countries and launched 20 syndicates and angel networks in 14 countries. As a Tech operator, he built the world’s largest API Marketplace with an a16z backed startup. He holds an MBA from INSEAD.

Jun Xian Lee

Co-Founder & Chief Product Officer

GoodWhale

Junxian is the Co-founder and Chief Product Officer of GoodWhale, a platform designed to empower aspiring investors with personalised tools for financial health and has previously co-founded Moovaz and CashShield. He also played a key role in launching Shopee at SEA Ltd, serves as a Venture Partner at Iterative Venture Capital, and is actively involved in philanthropy and education, having received the NUS Business School’s Eminent Alumni Award.

Vanessa Ho

Co-Founder

Fintech Nation

Vanessa brings deep expertise in venture building, early-stage investments, and corporate development. Vanessa co-founded Fintech Nation, spearheading the investment pillar, focusing on Southeast Asian startups and leading significant deals like a $5M debt financing for Sleek. She helped build NUS Alumni Ventures, establishing a community of over 100 angel investors and mentoring startups. At Partipost, Vanessa does corporate development and investor relations, contributing to strategic fundraising efforts, including a Series A+ convertible note round.

Please submit the following documents to [email protected]:

- Coloured copy (back and front) of NRIC for Singaporeans and PRs, or "Employment"/"S" Pass for foreign applicant

- Application form

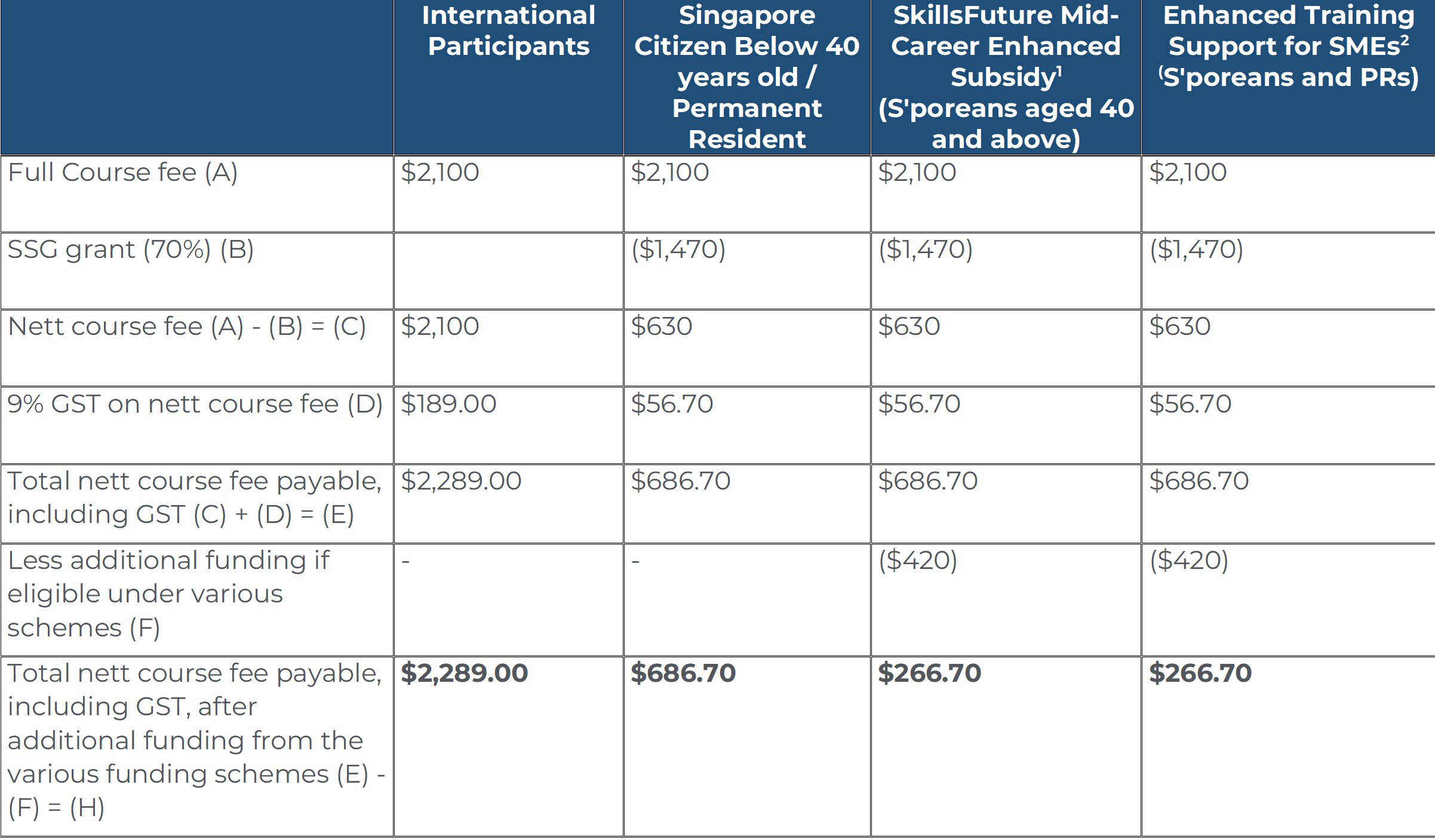

Course Fee

1 Mid-Career Enhanced Subsidy: Singaporeans aged 40 and above may enjoy subsidies up to 90% of the course fees.

2 Enhanced Training Support for SMEs: SME-sponsored employees (Singaporean Citizens and PRs) aged 21 and above may enjoy subsidies up to 90% of the course fees.

Participants are required to achieve at least 75% attendance and pass any prescribed examinations/assessments or submit any course/project work (if any) under the course requirement.

Participants are required to complete all surveys and feedbacks related to the course.

The course fees are reviewed annually and may be revised. The University reserves the right to adjust the course fees without prior notice.

Singapore University of Social Sciences reserves the right to amend and/or revise the above schedule without prior notice.

For clarification, please contact the SUSS Academy via the following:

Telephone: +65 6248 0263

Email:

[email protected]