Dates: 15 & 16 May 2025, 25 & 26 November 2025

Duration: 2 days

Level: Intermediate

Venue: Singapore University of Social Sciences

Corporate governance, the all-encompassing mechanism that imparts integrity, ethics, transparency, accountability, and culture, will ultimately steer an organization towards achieving long-term success and longevity. Robust governance arrangements include establishing a clear organizational structure, well-defined lines of responsibility, effective risk management processes, control mechanisms, and remuneration policies. The past few decades have proven that, in practice, these arrangements have fallen short of ethical business standards and have incentivised short-term thinking.

Multiple corporate actions and publications prove that there is a significant movement towards aligning the interests of the company with the interests of society. This shift has encouraged organizations to focus on a longer time horizon that will account for environmental, social, and governance (ESG) related risks and opportunities.

This course will impart the latest corporate governance practices that account for ESG considerations.

This course is a collaborative effort with Deloitte.

Entrepreneurs, business owners, C-suites, directors, function heads, senior managers, managers, sustainability consultants, financial consultants, operations manager, ethics manager/compliance manager, HR manager, etc.

- Defining Corporate Governance

- Relevance of Corporate Governance in the Asian Context

- Decoding the Singapore Code of Corporate Governance

- Corporate Governance and Risk Management

- Governance for Value Creation

- Types of Governance Mechanism

- When to Employ Governance Mechanism

- Applying Corporate Governance in Strategy Risk Management

- Integrating Corporate Governance and Sustainability Principles

- Transition and Succession for continuity

- Applying Corporate Governance and Governance Principles for the Next Generation Leader

- Future of Corporate Governance

A. Knowledge and Understanding (Theory Component)

By the end of this course, participants should be able to:

- Examine the fundamentals and purpose of corporate governance and its importance to a sustainable business

- Distinguish that corporate governance is a concept that can be adopted regardless of size and maturity of the organisation, by all levels within it

- Illustrate the role of corporate governance in managing stakeholders in the Asian context

- Compare the roles of the Board, Chairman, and CEO based on the Singapore Code of Corporate Governance

B. Key Skills (Practical Component)

By the end of this course, participants should be able to:

- Appraise the appropriate governance structure relevant to respective businesses

- Design sound corporate governance practices within their businesses

- Evaluate risk management sustainability and sustainability principles in business strategic planning

| Time | Agenda |

|---|

| Day 1 |

| 09:00 - 09:30 | Course overview |

| 09:30 - 10:15 | Defining Corporate Governance |

| 10:15 - 10:30 | Break |

| 10:30 - 11:15 | Relevance of Corporate Governance in the Asian Context |

| 11:15 - 12:30 | Decoding the Singapore Code of Corporate Governance |

| 12:30 - 13:30 | Lunch |

| 13:30 - 14:45 | Corporate Governance and Risk Management |

| 14:45 - 15:45 | Governance for Value Creation |

| 15:45 - 16:00 | Break |

| 16:00 - 17:30 | Types of Governance Mechanism |

| Day 2 |

| 09:00 - 10:00 | When to Employ Governance Mechanism |

| 10:00 - 11:00 | Applying Corporate Governance in Strategy Risk Management |

| 11:00 - 11:15 | Break |

| 11:15 - 12:15 | Integrating Corporate Governance and Sustainability Principles |

| 12:15 - 13:15 | Lunch |

| 13:15 - 14:30 | Transition and Succession for continuity |

| 14:30 - 15:45 | Applying Corporate Governance and Governance Principles for the Next Generation Leader |

| 15:45 - 16:00 | Break |

| 16:00 - 17:30 | Future of Corporate Governance |

| 17:30 - 18:30 | Assessment - Quiz |

- Attendees should have a basic understanding of environmental ecosystem.

- Have good English proficiency.

- Possess basic information and communication technology (ICT) skills.

- Possess basic understanding on climate change.

- Be able to source and analyse relevant materials from the workplace, library, internet or online databases for information on climate change.

Stefan Sapto Handoyo

Stefan Sapto Handoyo

Stefan Sapto Handoyo is an industrial and development economist and has more than 20 years of experience in multilateral and international organizations, including 5 years in investment services and 11 years in ESG/Sustainability advisory services of the International Finance Corporation (IFC, a sister organisation of the World Bank Group). He last held the position of Senior Corporate Governance (CG) Officer for investment services in IFC for Asia-Pacific, based in Mumbai. Key responsibilities included ensuring ESG/sustainability best practices of clients in line with IFC-World Bank Performance Standards and CG Methodology, delivering high-quality CG risk management support, and improving ESG processes and procedures. He has delivered many CG assessments and courses across different industries (financial institutions, infrastructure, manufacturing and agribusiness), supported the investment team in CG due-diligence for sovereign wealth funds and state-owned enterprises based on Santiago Principles and IFC SOE Directive, provided inputs on CG issues in transaction documents, as well as drafted CG action plans for clients.

Stefan is the key author of IFC CG Guidance, Tip-Sheet on Integrity Assessment, Tip-Sheet on Company Leadership and Tip-Sheet on Disclosure & Transparency. He was also responsible for the development of Board Leadership Toolkit, Disclosure and Transparency Toolkit, Family Business Governance (FBG) Toolkit and Guideline on CG for Subsidiaries. In 2019, Sapto received the Global President’s Award from the President of the World Bank Group for his contributions in the development and implementation of the IFC Disclosure and Transparency Toolkit – Beyond the Balance Sheet which has been widely used by companies in developing their sustainability and integrated reporting framework.

Stefan is an IFC-certified CG trainer, an Asian Development Bank certified trainer on micro-finance, a scholar of the International Corporate Governance Network (ICGN), and a qualified risk director.

Please submit the following documents to [email protected]:

- Coloured copy (back and front) of NRIC for Singaporeans and PRs, or "Employment"/"S" Pass for foreign applicant

- Application form

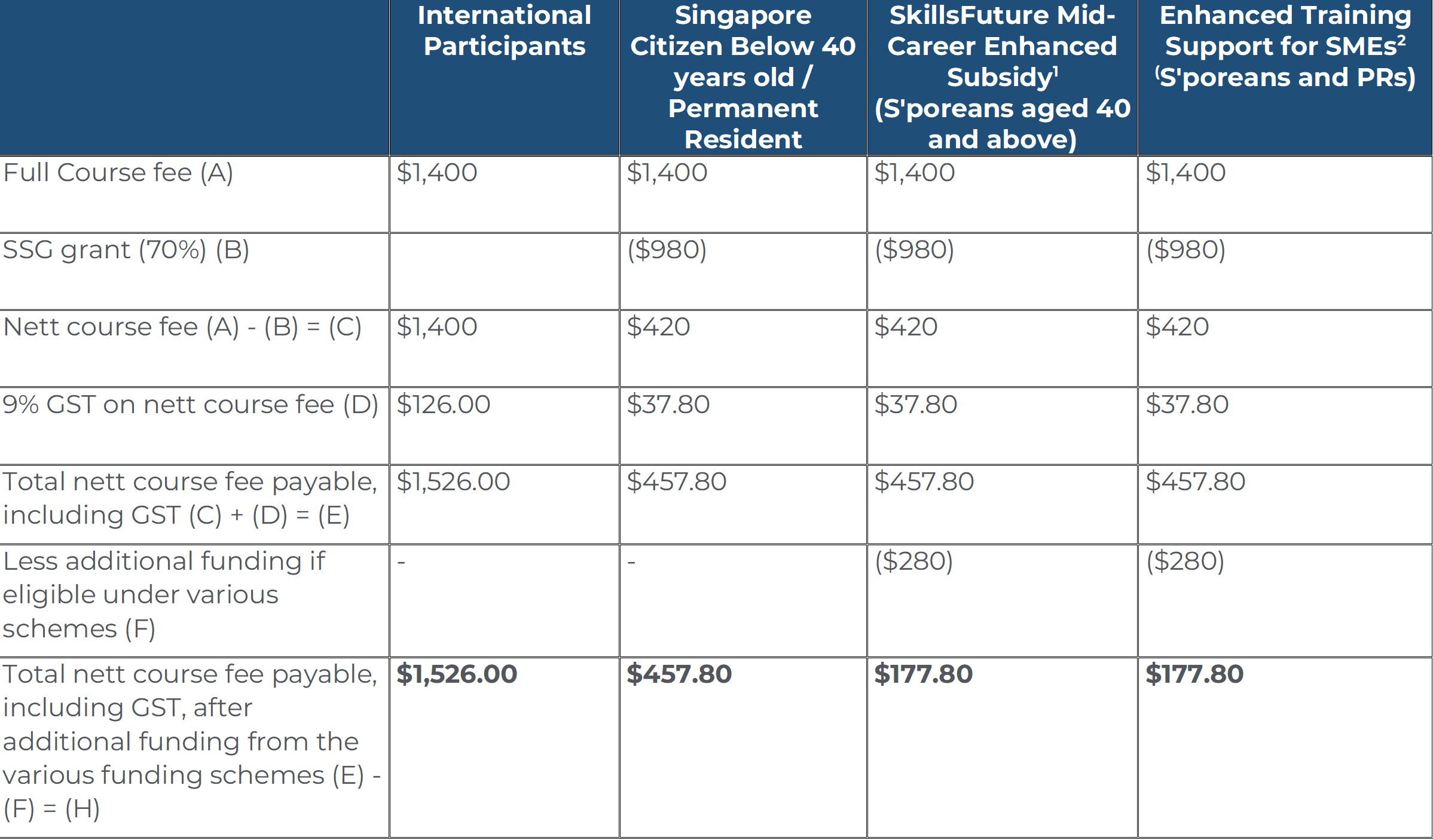

Course Fee

1 Mid-Career Enhanced Subsidy: Singaporeans aged 40 and above may enjoy subsidies up to 90% of the course fees.

2 Enhanced Training Support for SMEs: SME-sponsored employees (Singaporean Citizens and PRs) aged 21 and above may enjoy subsidies up to 90% of the course fees.

- Participants are required to achieve at least 75% attendance and pass any prescribed examinations/assessments or submit any course/project work (if any) under the course requirement.

- Participants are required to complete all surveys and feedbacks related to the course.

- The course fees are reviewed annually and may be revised. The University reserves the right to adjust the course fees without prior notice.

- Singapore University of Social Sciences reserves the right to amend and/or revise the above schedule without prior notice.

For clarification, please contact the SUSS Academy via the following:

Telephone: +65 6248 0263

Email:

[email protected]