Dates: 4 March 2025,18 August 2025

Level: Intermediate

Duration: 1 day

Venue: Singapore University of Social Sciences

The "Net-Zero Investment Strategies" course is designed to equip participants with the knowledge and skills needed for sustainable investing in the context of global net-zero ambitions. In this one-day program, participants will explore the profound implications of global net-zero targets for the economy. They will learn methods to assess a company's alignment with net-zero goals and discover diverse approaches to evaluate net-zero considerations at the portfolio level. Real-world examples of net-zero investment products and services will provide practical insights to guide participants in making informed investment decisions in today's rapidly changing financial landscape.

By the end of this one-day course, participants will have gained a thorough understanding of the global net-zero ambition, how to assess company alignment with net-zero goals, methodologies for portfolio-level net-zero assessment, and examples of net-zero investment products and services. They will be better equipped to make informed investment decisions that contribute to a sustainable, low-carbon future.

This course is suitable for finance professionals, investment managers, ESG analysts, and individuals seeking to align their investments with net-zero objectives.

- Introduction to Net-Zero Ambition

- Implications for the Economy

- Assessing Company Alignment with Net-Zero

- Emissions Reduction Strategies

- Methodologies for Portfolio-Level Assessment

- Carbon Footprint Analysis

- Examples of Net-Zero Investment Products

- Selecting and Integrating Net-Zero Investments

By the end of this course,

- Gain awareness of global net-zero targets and their implications for the economy.

- Explore the potential risks and rewards associated with net-zero investment strategies and make informed investment decisions.

- Analyze sustainability reports and climate disclosures to assess a company's alignment with net-zero objectives.

- Assess the effectiveness of different methodologies for evaluating net-zero considerations at the portfolio level.

- Apply various net-zero assessment techniques to evaluate the carbon footprint and emissions reduction strategies of investment portfolios.

- Discuss the integration of portfolio-level net-zero assessment plan that incorporates climate risk modelling and scenario analysis.

- Create an investment strategy that aligns with net-zero goals, considering carbon neutrality and sustainable returns.

- Apply practical strategies for selecting and integrating net-zero investment products into portfolios, considering financial and sustainability objectives.

A. Knowledge and Understanding (Theory Component)

By the end of this course, participants should be able to:

- Identify key ESG (Environmental, Social, Governance) factors relevant to net-zero investing.

- Explain the concepts and implications of different net-zero approaches, including exclusion-based, best-in-class, and integrated approaches.

- Articulate net-zero assessment techniques to evaluate the carbon footprint and emissions reduction strategies of investment portfolios.

- Interpret sustainability reports and climate disclosures to assess a company's alignment with net-zero objectives.

B. Key Skills (Practical Component)

By the end of this course, you should be able to:

- Analyze the economic implications of transitioning to a net-zero economy, considering the impact on various sectors and industries.

- Critically evaluate a company's sustainability initiatives and emissions reduction strategies in the context of net-zero goals.

- Develop strategies for selecting and integrating net-zero investment products into portfolios, considering financial goals and sustainability objectives.

- Evaluate the potential risks and rewards associated with net-zero investment strategies and make informed investment decisions.

| Time | Agenda |

|---|

| Day 1 |

| 09:00 - 09:30 | Course overview |

| 09:30 - 10:30 | Introduction to Net-Zero Ambition

Implications for the Economy |

| 10:30 - 10:45 | Break |

| 10:45 - 12:00 | Assessing Company Alignment with Net-Zero

Emissions Reduction Strategies |

| 12:00 - 13:00 | Lunch |

| 13:00 - 15:30 | Methodologies for Portfolio-Level Assessment

Carbon Footprint Analysis |

| 15:30 - 15:45 | Break |

| 15:45 - 17:00 | Examples of Net-Zero Investment Products

Selecting and Integrating Net-Zero Investments |

| 17:00 - 18:00 | Assessment |

|

- Written Assessment – Short Answer Questions

- Written Assessment – Case-study with Questions

- Attendees should have a basic understanding of Finance and ESG fundamentals

- Attendees have to bring along their own laptop

Sapto Handoyo

Stefan is currently an Associate Director of Deloitte Konsultan Indonesia (DKI), Risk Advisory based in Jakarta, Indonesia. He is an Indonesian national with a mix of investment and Corporate Governance (CG) and Sustainability experience of more than 20 years, including 7 years at the International Finance Corporation (IFC) - World Bank Group (WBG) in Asia-Pacific Region and 4 years at IFC Sub-Saharan Africa based in Nairobi, Kenya. He received the WBG Global President’s Award 2019 for his role in the development and promotion of IFC Disclosure and Transparency Toolkit. He was the Program Manager of CG Advisory Services in IFC East Africa based in Nairobi from 2016-2020. He first joined IFC Investment Services in 1998. He led IFC local CG team in providing key TA support to capital market regulators in Indonesia and East African countries. He has supported IFC investment clients across Asia-Pacific and Sub-Saharan Africa region in improving their CG structures and practices.

Please submit the following documents to [email protected]:

- Coloured copy (back and front) of NRIC for Singaporeans and PRs, or "Employment"/"S" Pass for foreign applicant

- Application form

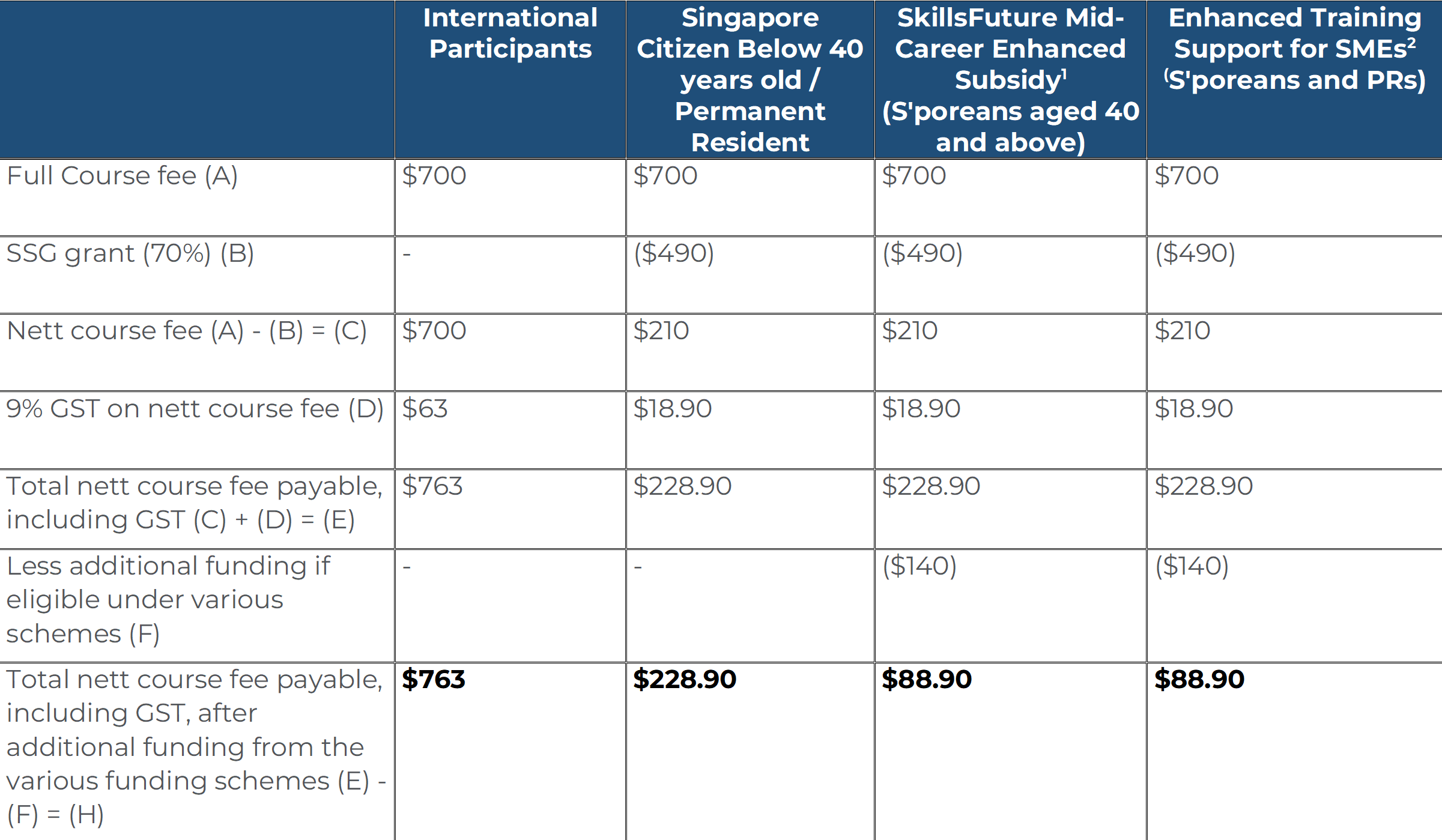

Course Fee

1 Mid-Career Enhanced Subsidy: Singaporeans aged 40 and above may enjoy subsidies up to 90% of the course fees.

2 Enhanced Training Support for SMEs: SME-sponsored employees (Singaporean Citizens and PRs) aged 21 and above may enjoy subsidies up to 90% of the course fees.

Participants are required to achieve at least 75% attendance and pass any prescribed examinations/assessments or submit any course/project work (if any) under the course requirement.

Participants are required to complete all surveys and feedbacks related to the course.

The course fees are reviewed annually and may be revised. The University reserves the right to adjust the course fees without prior notice.

Singapore University of Social Sciences reserves the right to amend and/or revise the above schedule without prior notice.

For clarification, please contact the SUSS Academy via the following:

Telephone: +65 6248 0263

Email:

[email protected]